The problem we see

We have watched it happen too often - paychecks slip away on rent, cab / rick fares, food and weekend plans. Employees earn, spend, switch jobs, and start over. No savings. No stability.

As a team with roots in fintech, we felt this pain - seeing talented people stuck in a cycle and companies losing them to attrition. That’s why we built Salary SIPs: to break the loop and boost everyone’s future.

Our Solution?

Salary SIPs.

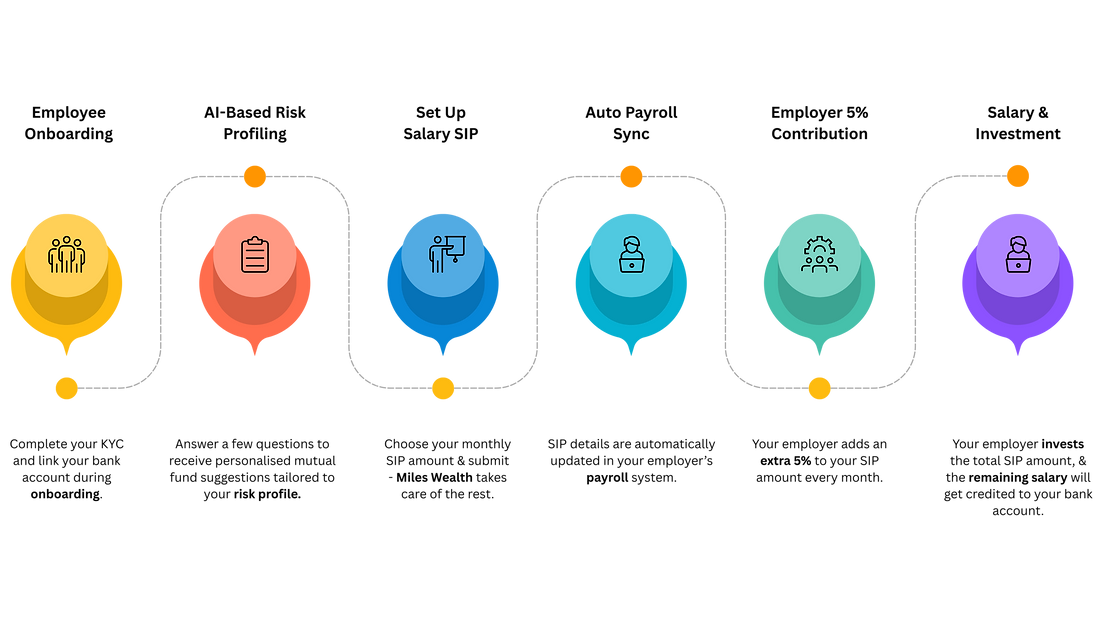

Salary SIPs are a payroll - deducted savings program that lets employees invest a portion of their salary directly into personalised mutual funds supported by AI based risk assessment. Powered by seamless automation and boosted by a 5% employer contribution, it helps break the paycheck-to-paycheck cycle, promoting financial wellness for employees and companies alike.

.png)

How does Salary SIP work?

What's in it for Employees?

-

Automated Savings: Effortless deductions mean consistent investing without manual effort.

-

Personalized Growth: AI powered Risk Assessment helps us recommend personalised mutual funds that suits your financial goals.

-

Extra Boost: The 5% employer contribution accelerates your savings and builds wealth faster.

-

Financial Freedom: Reduces stress from living paycheck to paycheck, fostering long-term stability.

-

Easy Monitoring: Track investments, invest more, redeem, switch and more - anytime using Miles Wealth app!

What's in it for Employers?

-

Enhanced Retention: Employees stay longer when supported with meaningful financial perks.

-

Higher Productivity: Financial wellness reduces stress, leading to a more focused workforce.

-

Low-Effort Implementation: Seamless payroll integration requires minimal setup or oversight.

-

Cost-Effective Benefit: Could cost the company about less than 0.5% of the total employee cost. For more details, check out our calculator.

-

Competitive Edge: Positions your company as employee-centric in talent attraction.